Foreclosure FAQ

What does foreclosure mean?

Foreclosure means a lender attempts to recover an amount owed on a default loan through the legal process of taking ownership and selling the mortgaged property.

A common example is if someone gets behind on payments to their house, then the company they owe can take it to sell.

What is the best way to avoid foreclosure?

So if you’re behind on payments and worried about losing the house, what can you do to prevent that from happening? While there are no guarantees in the legal world, the next step would be to prepare to fight your case legally if you cannot catch up on payments now.

While it is possible to file bankruptcy alone, the best chance you have of stopping foreclosure through bankruptcy is by filing with an attorney.

Can you make a foreclosure stop once it starts?

Yes! You can stop a foreclosure at any point before the house is sold. The beginning of the foreclosure process does not have to be the end of your house being yours.

Can you file bankruptcy on a foreclosed home?

If the house is not sold yet you may still keep the house through filing bankruptcy. You can take action immediately by consulting with an attorney!

When is it too late to stop foreclosure?

Once the foreclosure process has ended it is too late to stop it. So you have until the house gets sold to avoid losing your house to foreclosure.

How can you make a foreclosure stop immediately?

Hiring an attorney allows you to restructure your finances to keep your home and pay off your debts. Filing bankruptcy will stop the foreclosure process. An automatic stay will come into place to stop the house from being taken. Then paperwork can be submitted to reorganize payments.

Read about what happens during the Bankruptcy Process below for how it works.

How long can filing bankruptcy delay foreclosure?

USC Title 11, Section 362, provides for an automatic stay that protects you from being foreclosed for 90 days. Then a form Schedule D could be filed to adjust interest and set up a payment plan, including back mortgage. The monthly payment could be changed after that for the next 3 to 5 years.

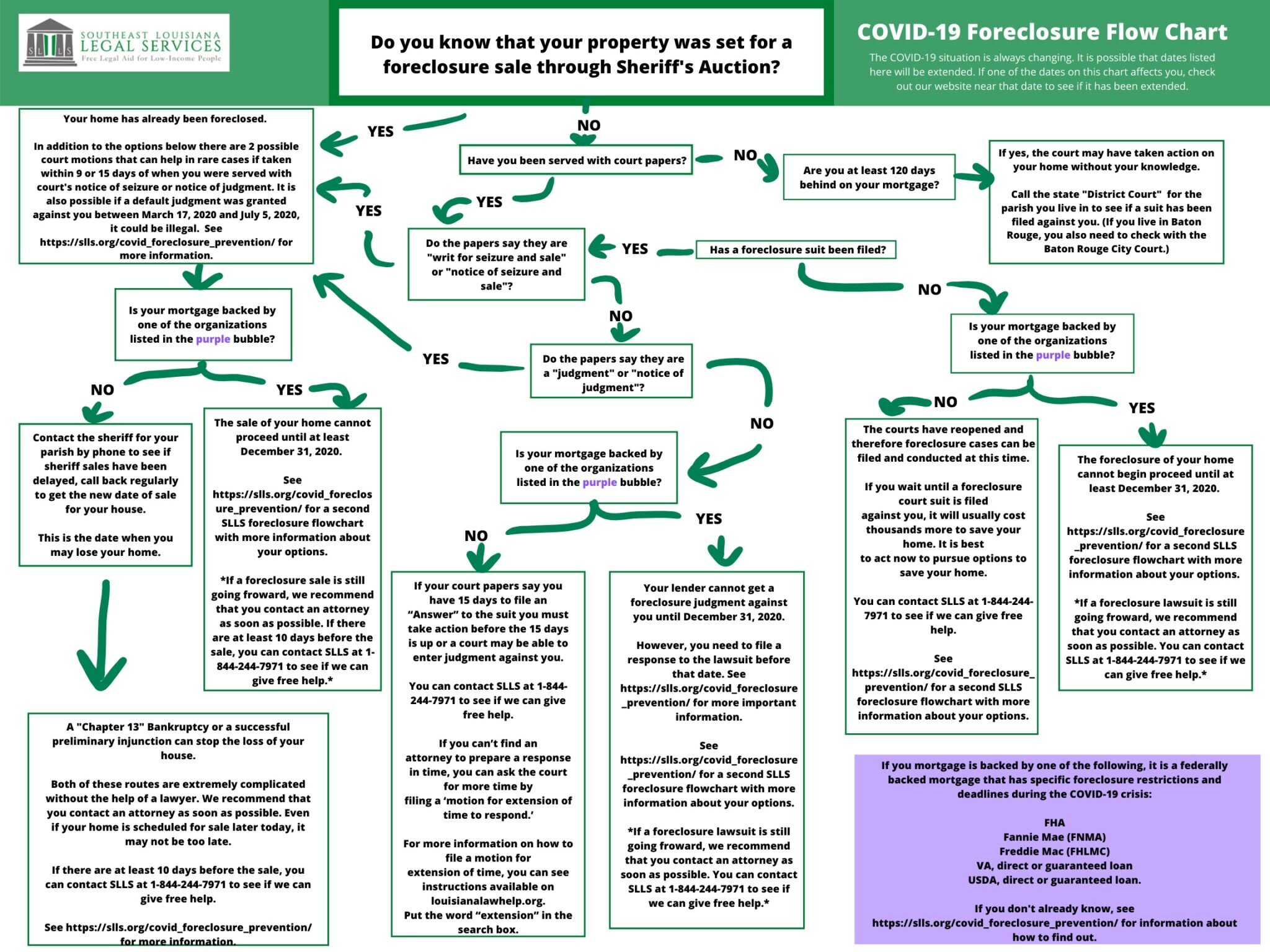

Can my lender foreclose on me during the COVID crisis?

Your lender can still foreclose on you during the pandemic!

If the suit has not been filed against you yet, your best chance at saving thousands of dollars is to work with an attorney before you are foreclosed upon.

I missed or avoided the sheriff who is trying to serve papers. Is my home safe?

No! In fact, if the sheriff has followed procedure and you are not responding, an attorney could even be appointed to take action without you knowing it. The best way to keep your home safe is to get your own attorney!

Can I get help to afford my loan?

Mortgage companies have no reason to negotiate with you by yourself. Legally they have the upper hand.

However, attorneys know which laws they can use to make lenders cooperate.

I have been served with court foreclosure papers. What do I need to do?

Get a lawyer to respond to any papers as soon as possible!

Each stage of the court process has its own timeline and requirements. Attorneys know what to and when to do it.

Are sheriffs auctioning homes during the pandemic?

Yes! On top of that, they do not have to notify you of any date changes.

Foreclosure auctions can happen online. If you are worried about losing your house, you must stay on top of your sale date.

What court papers could I be served with and what do they mean?

Notice of Seizure and Sale

Notice to Answer Suit

Notice of Judgement

These papers mean the court is going to take your house. See an attorney ASAP to help!

Foreclosure Quick Facts:

Foreclosure isn’t always the end of repayment when you get behind on a loan.

For example, if your house doesn’t sell for enough money to cover the cost of the loan, you may still owe money to the lender.

Filing Chapter 13 Bankruptcy is an optimal solution for many foreclosures.

Keep scrolling to read which chapter may be right for you...

There are two ways your mortgage company can foreclose on you:

ordinary process

executory process

Most mortgage companies use executory process.

Executory process is much quicker than ordinary process and streamlines foreclosure.

Things to know about executory process

Your mortgage company can sell your home without giving you a copy of the suit. Normally, the sheriff has to bring you a copy of the lawsuit, which is called the Petition. After that, you would normally get fifteen (15) days to respond and fight it out in court. With executory process, the court doesn’t have to give you the Petition, and you don’t get to respond. The sheriff has the right to take the property and move forward with the sale. You have to use other strategies to stop a foreclosure.

The sheriff MUST serve you with a Notice of Seizure before selling your home. While the sheriff doesn’t have to serve you with a copy of the Petition, the sheriff does have to serve you with a Notice of Seizure to let you know that the home has been seized and will be sold. The notice gives you details about the sale, such as when and where it’ll happen. Once you get it, it is imperative you get a lawyer if you want to save your home. Do not delay. The Notice of Seizure may be the only actual notice you’ll get before your home is sold.

The sheriff only has to advertise the sale twice before proceeding. After three days, the sheriff then has to advertise the sale twice. They will usually try to do that in the newspaper. There may also be an appraisal of your home before the sale moves forward. Once the sale is advertised and appraised, it’s only a matter of time before the property is sold unless you take action.

There are ways to stop the foreclosure process. If you are behind on payments and need help, call (504) 226-2292 today for a free consultation.

Is it better to foreclose or file bankruptcy?

So if you’re behind on payments and worried about losing the house, what can you do to prevent that from happening?

While there are no guarantees in the legal world, the next step would be to prepare to fight your case legally if you cannot immediately catch up on payments.

You can defend yourself, put together a plan, and act now to start fresh!

...Or you could lose your house and continue struggling with debt.

Which bankruptcy stops foreclosure?

Chapter 13 is optimal for stopping foreclosure. You may be able to reorganize your finances to keep your house!

Someone dealing with foreclosure may not want to file Chapter 7 to avoid risk of losing home.

Should you file Chapter 7 or Chapter 13 bankruptcy?

In terms of foreclosure, the biggest difference between Chapter 7 and Chapter 13 is that with Chapter 7 the trustee controls the assets versus with Chapter 13 the person filing retains control of their property.

So if you file Chapter 7 someone else can decide to sell your stuff, including your home, even if you do not agree.

If you file Chapter 13 no one else gets to decide what happens to your belongings.

“Won’t I have to sell everything? What’s the point of bankruptcy if I sell my home?”

No, you don’t have to sell everything and you don’t have to lose your house. This is a common misconception due to the different types of bankruptcy. There are two main chapters for bankruptcy: Chapter 7 and Chapter 13. In a Chapter 7 bankruptcy, a debtor potentially has to sell all of their assets. But in a Chapter 13 bankruptcy, you get to keep your home!

“Won’t bankruptcy hurt my credit? I spent years building it. I don’t want to ruin it now.”

While bankruptcy does temporarily dampen your credit, keep in mind that not paying your mortgage, credit card bills, and other expenses leads to damaged credit as well, but without any benefits. Moreover, your credit score can actually improve rather quickly after bankruptcy because creditors know that you can’t file for bankruptcy again for a few years.

If you’re not looking to buy a car or another home anytime soon, then now might be the time to start rebuilding your credit so you afford these things in the future. If you already have poor credit, then a Chapter 13 bankruptcy makes even more sense. The process will allow you to keep your home, make your debt easier to pay off, and put you on the path towards fixing your credit.

“Isn’t filing for bankruptcy a bad thing? I don’t want to feel like a failure.”

Right now, we’re in one of the worst economies in U.S. history caused by a pandemic that no one could have predicted. Millions of innocent people have lost their jobs. Millions more are going to lose their homes. Those people deserve support, not stigma, and so should you. Bankruptcy exists for situations just like this. You shouldn’t feel bad for exercising your rights.

The fact is that people who file for bankruptcy are just like you. They’re friends, co-workers, and loved ones. You may have people you’re close to who have filed for bankruptcy and don’t even know it. Also, there are plenty of people who have filed for bankruptcy and gone on to achieve success in life, people like Walt Disney, Marvin Gaye, and even Abraham Lincoln.

Part of the stigma in my opinion is created by our financial institutions. Your creditors don’t want you to file for bankruptcy because they know how much it’ll help you. They want you to pay back these debts even if it’s not possible or unreasonable.

The bank already has enough money. Why does it need your home too?

7 reasons not to do it yourself

If you negotiate with the mortgage company yourself, there are no laws or protections in place to save you money.

Due to adversarial procedures, mortgage companies can simply not agree with reasons to adjust a payment plan that a lawyer would be able to push on your behalf.

You could cost yourself money, time, or your house if you make a simple mistake.

If you make any major errors you could even end up under investigation for fraud.

Attorneys can provide you with all the exceptions and exemptions applicable to you to save money.

Attorneys can track down all of your finances to make sure you won't owe any more money (for example if you have more than one mortgage you will need to be careful).

Attorneys know how to present your case to the court and your creditors to give you the best chance of debt relief.

Glossary:

Book a free consultation to learn more information at (504) 226-2292.

Term: Lender

LA Revised Statutes: RS 6:969.6, RS 6:1083, RS 6:1096

Definition: An entity that lends assets to someone is called a lender.

Example: When a mortgage company loans someone money, the mortgage company becomes that person’s lender.

Term: Mortgage

LA Revised Statutes: RS 6:822, RS 6:1083, RS 40:600.87, RS 40:600.111

Definition: A contract that allows someone to utilize property as leverage to secure funding.

Example: Sharon took out a mortgage on her home to make ends meet.

Term: Lien

LA Revised Statutes: RS 10:9-102

Definition: A privilege on personal property that entitles the person who is privileged to be paid back before other creditors

Example: If a mortgage company has a lien on your house, and you file bankruptcy, they would be paid back first.

Term: Automatic Stay

U.S. Code: 11 U.S. Code § 362

Definition: An automatic stay stops a lender from being able to contact a debtor for a certain time frame.

Example: A mortgage company cannot sell a house once an automatic stay is in place.

Term: Schedule D

IRS: About Schedule D, Form 1040

Definition: Adjustments to income or debts that haven’t been reported on other forms can be filed to the IRS using a Schedule D.

Example: Filing a Schedule D after bankruptcy can allow someone to adjust interest and payments.

Term: Trustee

LA Revised Statutes: RS 9:2343

Definition: The trustee is a private attorney appointed to a panel by the office of the United States Trustee, a division of the Department of Justice, to oversee bankruptcy cases.

Example: If you file bankruptcy, a trustee may have control over your stuff depending on which chapter you choose.

**Disclaimer: This content is not legal advice and does not create an attorney client relationship.

If you are seeking assistance from a lawyer in New Orleans, please book a free consultation at (504) 226-2292.